CompaniesAP Møller-Mærsk shares run aground on 2016 warning

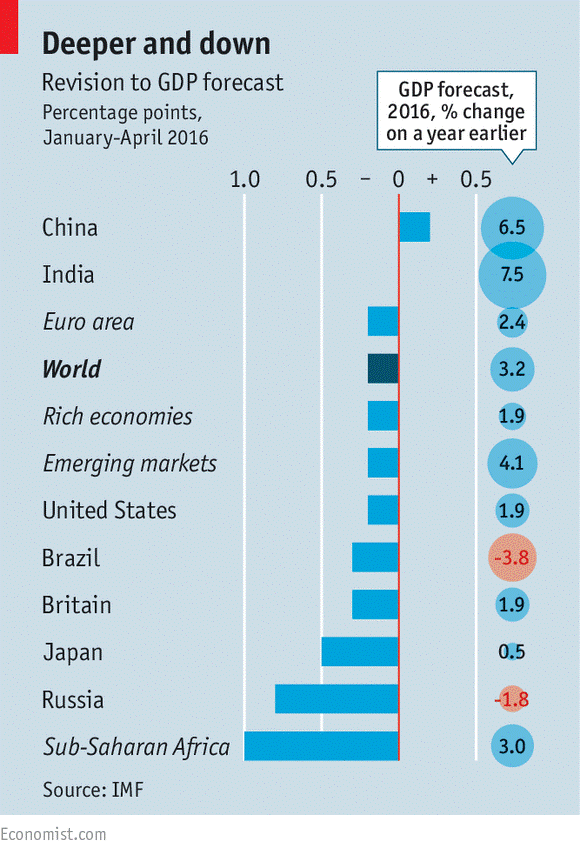

AP Møller-Mærsk is the biggest faller in Europe in early trading on Wednesday after the Danish container shipping giant, which has suffered a rocky 12 months, warned this year won’t be any better and it expects underlying results for 2016 to be “significantly lower”.

The warning has sent its shares down 8.6 per cent to DKr 7,500, making it the biggest faller on the pan-European FTSE Eurofirst 300 index early on Wednesday, writes Nathalie Thomas.

Underlying profits in 2015 dropped to $3.1bn from $4.5bn a year earlier but the slump in net profit was even worse, falling 82 per cent to just $925m as the company, whose businesses range from shipping to oil and gas, suffered from low crude prices, weak trade and uncertainty over the direction of the global economy.

Demand for transporting goods by sea has been especially weak in emerging markets but the downturn has also coincided with an over-supply of vessels in the industry.

New ships were ordered in the industry up to four years ago when economic growth was expected to be much stronger, Mærsk said. The delivery of those vessels has come at just the wrong time, as demand weakens.

The Danish conglomerate has been cutting thousands of jobs to try and deal with the downturn.

AP Moller-MaerskCompaniesDenmarkShipping

Economic Statistics from Japan

Financial Times provide this excellent portal https://ig.ft.com/sites/numbers/economies/japan

January 27, 2016 Fordaq The Japanese Lida Group Holdings

intends to invest 10 billion yen (about $84.3 million) in various construction projects abroad. One of these projects is the wood processing plant in the Russian Far East.

According to the Japanese magazine Nikkei Asian Review, Iida Gruppo has recently acquired 25% of shares of the Russian forestry company – Primorsklesprom – for 500 million yen.

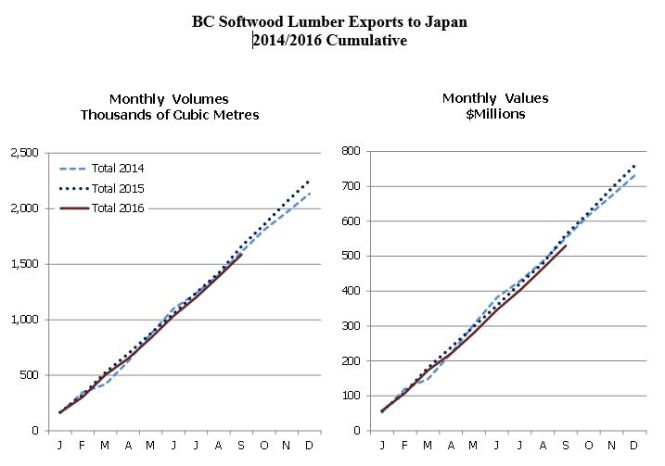

In 2016, Lida Group is planning to start the production of wooden houses and build a wood processing plant near Vladivostok, Russia. Lumber will also be partially exported to Japan.

Lida Group also plans to access such markets as USA, China, Southeastern Asia. According to the magazine, the Japanese company’s goal is to increase sales on the foreign markets due lack of demand on the domestic market.

Fordaq Housing Starts In Japan

February 1

Housing starts in Japan unexpectedly fell in December 2015, after a steady increase in November, data from Japan’s Ministry of Land, Infrastructure, Transport and Tourism showed Friday.

Housing starts dropped 1.3 percent year-over-year in December, while in November, it grew 1.7 percent. Economists were expecting a 0.5 percent rise in December.

The number of annualized housing starts decreased to 860,000 in December from 879,000 in the preceding month. It was expected to rise to 888,000.

Construction orders received by 50 big contractors grew 14.8 percent annually in December, much faster than the 5.7 percent spike a month earlier. It was the second successive monthly gain.

Don’t shed a tier

How to make negative rates less painful

Feb 3rd 2016, 11:26 by B.L. | LONDON

NEGATIVE interest rates are intended to give the economy a boost. But one potential side effect can be to damage the banking system. A cut to official interest rates feeds through into money markets. In addition to moving the exchange rate, that affects asset prices and wholesale borrowing rates.

Commercial banks generally react by lowering the rate they charge borrowers. Banks would normally pass that reduction on to their depositors but, as depositors by and large refuse to pay for their accounts, they find it difficult to push their deposit rates below zero.

That means that once official rates hit zero, further cuts reduce banks’ lending rates but not their borrowing rates. That squeezes their net interest margin—the main way they make money. Though the mechanisms are as yet unknown, some worry that if banking becomes unprofitable, banks might cut back on their lending. That could be economically detrimental. Central banks are therefore keen to find ways of pushing interest rates below zero without damaging their banking systems’ profitability. They have tried to do this in a number of ways.

The Bank of Japan (BoJ), which pushed its main policy rate negative last week, did it by introducing a complicated three tier interest rate structure. The headline negative rate will only apply to new balances created by the Bank’s continuing quantitative easing—what the BoJ terms “policy-rate balances”. Old balances—called the “basic balance”—will continue to earn interest. As the stock of reserves in the system grows the Bank plans to increase its “Macro add-on balance”—which receives 0% interest—so that only banks’ marginal reserves attract the negative rate. The negative rate on policy-rate balances should be passed on to borrowers. As the policy rate balances are only a small fraction of total reserves, bank profitability shouldn’t get hit too badly.

This mimics how Switzerland and Denmark have implemented negative interest rates. Each Swiss bank is allocated a “threshold” by the Swiss National Bank—usually 20 times its reserve requirement. Only reserve balances in excess of that threshold attract the negative interest charge.

Cleverly, the threshold gets reduced if banks withdraw their reserves and hold cash—so as to prevent them from avoiding the charge by hoarding banknotes. Denmark’s central bank does something similar. It imposes a limit on reserve balances—which do not attract negative interest.

Any excess is converted into “certificates of deposit”, which attract a charge of -0.75%.

These schemes should allow banks to remain profitable even in a negative interest rate environment. It is worth asking who pays, though. Central banks earn a profit—known as seigniorage—by earning a higher interest rate on their assets (usually loans to the banking system and government bonds) than they pay on their liabilities (cash and bank reserves). That profit flows to the government. The tiered system Japan has introduced should—if it works—lower market interest rates without a concomitant reduction in the interest rate paid on reserves. That in effect transfers some seigniorage (profit made by a government by issuing currency) revenue to the banking system.

Asia dips amid banking sector concerns, yen stands tall

Shinichi Saoshiro

TOKYO — Reuters

Published Tuesday, Feb. 09, 2016 7:55PM EST

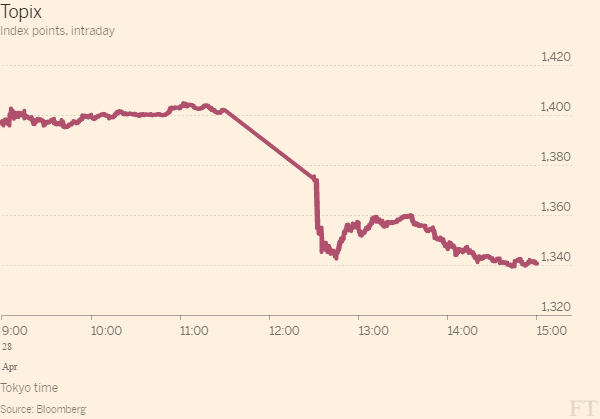

Asian stocks dipped early on Wednesday amid smouldering banking sector concerns, particularly banks in Europe, while the safe-haven yen stood atop large gains made overnight.

MSCI’s broadest index of Asia-Pacific shares outside Japan edged down 0.2 per cent. The decline was limited after Wall Street shares cut most of their losses overnight and gave battered risk assets some relief.

Australian stocks fell 1 per cent. Japan’s Nikkei lost 0.2 per cent after sinking 5.4 per cent on Tuesday.

Equity markets remained wobbly after being hit hard early in the week by worries about the health of the euro zone banking sector, with a very easy monetary policy seen crimping bank profits and consequently their ability to repay debt.

Trouble for equities has meant a boon for government bonds, with the Japanese government bond 10-year yield dropping into the negative for the first time on Tuesday and the U.S. Treasury benchmark yield declining to a one-year trough.

The yen, often sought in times of financial market turmoil, has also received a strong boost this week. The dollar traded at 114.96 yen after sinking to a 15-month low of 114.205 overnight. The euro was flat at $1.1288 after scaling a four-month high of $1.1338 overnight on the dollar’s broader weakness.

After a tumultuous start to the week, markets looked to Federal Reserve Chair Janet Yellen, who will address the U.S. Congress later in the session, for fresh cues and possible relief.

While Yellen is expected to defend the Fed’s first rate hike in a decade and likely insist that further rises remain on track, any signs of a departure from such a stance could provide risk assets with a breather.

“The narrative that she faces is that the U.S. economy and asset markets are being sucked into the downdraft caused by oil, China, emerging markets, reserve manager and sovereign wealth fund asset selling, commodities, currency war, the strong dollar, weak European banks, weak Japanese banks, weak US banks and policy ineffectiveness…to name a few,” wrote Steven Englander, global head of FX strategy at Citi.

In commodities, crude oil prices trimmed some of their sharp losses suffered overnight. U.S. crude was up 1.6 per cent at $28.39 a barrel. Crude sank nearly 6 per cent on Tuesday after weak demand forecasts from the U.S. government and a rout in equities pressured prices.

Spot gold fetched $1,189.36 an ounce, staying near a 7-1/2-month peak of $1,200.60 stuck on Monday on the back of the risk aversion in the wider markets.

BoJ negative rates what you need to know

©Bloomberg

Japan crossed a “financial rubicon” on Tuesday as the country sold new 10-year bonds with a yield below zero for the first time at a government auction.

The sale is the latest sign of a worldwide collapse in borrowing costs which has upended assumptions about the workings of financial markets, as policymakers take ever more drastic steps to stimulate economic growth.

It also highlights the challenge of retaining support for unconventional central bank measures, with Prime minister Shinzo Abe struggling to maintain momentum behind his “Abenomics” growth policies.

Disruption and uncertainty created by the Bank of Japan’s announcement of negative interest rates has left 50 per cent of voters dissatisfied with the government’s economic policy, according to a Nikkei poll published earlier this week.

The world’s third-largest economy last month followed Switzerland, Sweden, Denmark and the European Central Bank by cutting short-term interest rates below zero to prevent stagnation and deflation.

“I don’t think it would be surprising if one day this happened in Germany,” said Peter Goves, European interest rate strategist for Citi.

The European Central Bank is expected to announce further monetary easing next week, and 10-year Bunds yield only 13 basis points.

Japan is the second country to sell 10-year bonds at a negative yield, after Switzerland became the first to do so in April last year

The auction, of Y2.2tn ($19.4bn) in 10-year paper, at an average yield of minus 0.024 per cent, means investors have paid a fee to lend money for a decade to the government, the most indebted G7 nation.

The buying appears to have been almost entirely dealers and speculators looking to hold the paper for a brief time or covering short sales accumulated in expectation of the yield dropping into negative territory. Traders expect much of it to be flipped directly back to Japan’s central bank in a few weeks as part of a bond-buying programme, also designed to stimulate the economy.

Big investors, which include Japan’s largest pension funds and banks, are understood to have stayed away from the auction as the fund management industry readjusts its strategies for the distortions of a financial environment where negative rates become the norm.

As well as forcing wholesale adjustments to the structure of many investment products, analysts at Nomura have warned that the JGB market could now be prone to regular phases “where fair prices are no longer obvious”.

Analysts described Tuesday’s JGB sale as the latest in a string of “inevitable distortions” that have descended on Japan, which has a gross debt/gross domestic product ratio of 250 per cent, since the BoJ revealed its negative rates policy (NIRP) on January 29.

Koichi Sugisaki, fixed-income strategist at Morgan Stanley MUFG Securities, said: “Going into the auction, most dealers believed that it wouldn’t make sense to investors to buy [the 10-year JGB] at negative rates so they took out short positions and today’s auction would have seen them buying to short-cover.”

Sub-zero rates are a sign that policymakers are running out of options to invigorate the economy, say critics

Another motive behind the dealers’ buying appears to be a straightforward play on the BoJ’s upcoming “rinban” bond purchases and the opportunity to sell to the central bank at a profit.

The 10-year notes sold at Tuesday’s auction will not be eligible for the buying operations scheduled for Wednesday this week but can be sold into the rinban operations scheduled for March 18.

The potential for Japan’s first negative-yield auction of the 10-year JGB had already convinced large pension funds to stay away.

In a note to clients published on Monday, fixed-income analysts at Barclays said: “We see no need to be particularly aggressive at tomorrow’s auction, either outright or on a relative value basis.”

The difficulty facing the big pension funds, however, is that they cannot stay away from the auctions forever if their mandates include following particular bond indices. The current response, say analysts, has been to dip further into the super-long end of the JGB market.

Other market side-effects of NIRP include the unsecured overnight call rate — ground zero for interbank lending — hitting zero last month on thin volumes as the Japanese financial system scrambles to update its computer systems to accommodate the mathematics of negative rates.

Barclays analysts said long-term yields had probably fallen too far and that because G20 central bank governors and finance ministers had made a public pledge to use all available policy tools to stabilise markets, the global risk-off trend may now take a breather.

South Korea impasse delays labour market shake-up

February 25, 2016 3:46 amSimon Mundy in Seoul

©Bloomberg

Sparks fly: tensions between unions and Seoul have mounted over law changes the IMF says are vital to make hiring easier

When South Korean trade unionists launched a campaign against labour law reforms, they did so by a statue of Jeon Tae-il.

The 22-year-old labour activist’s 1970 self-immolation, in protest over miserable working conditions in Seoul sweatshop factories, is seen as a pivotal event that helped galvanise the workers’ rights movement in military-ruled South Korea, and the broader movement towards democracy.

Labour unions are portraying their current fight against the reforms as a continuation of Jeon’s battle for justice — but critics accuse them of seeking to derail measures that would create jobs for the swelling ranks of unemployed youth to protect relatively privileged older workers.

With growth slowing, the official under-30 jobless rate reached 9.2 per cent last year: the highest in the current data series starting in 1999. That is widely seen as understating the problem, with many young graduates caught in precarious low-paid work while hunting for career opportunities.

Economists at the International Monetary Fund and elsewhere have long argued that the government must reduce protections and entitlements for workers to encourage more hiring, with companies deterred by the cost and risk of expanding their labour force.

“In the medium term, more flexibility in the labour market would help to boost labour productivity, which has slowed markedly since 2012,” says Kwon Young-sun, an economist at Nomura. “But in the short term people will feel concern about job security.”

In the first such pact since the late-1990s Asian financial crisis, the government of Park Geun-hye in September agreed with business and labour representatives on a joint process to overhaul the country’s labour laws.

But union leaders last month declared that deal void, arguing that the government had broken its accompanying pledge not to introduce reforms without further consultation. In December the labour ministry issued guidelines to employers saying they could now dismiss workers for poor performance, not only in cases of grave misconduct or corporate financial distress.

“President Park Geun-hye is very friendly with the chaebol conglomerates,” says Lee Jeong-sik, deputy general secretary of the Federation of Korean Trade Unions, the country’s biggest labour group. “I see her government trying to give favours to Samsung and Hyundai.”

Tear gas and water cannon used in largest anti-government protest for 7 years

Strong union resistance has prompted the government to withdraw a proposed bill that would have extended the maximum employment period for temporary workers. Four other pieces of legislation, including one that would expand the range of industries allowed to use temporary staff, have been stalled in parliament amid resistance from liberal lawmakers.

The drive to expand temporary work is misguided, argues Kim Yoo-sun of the Korea Labour & Society Institute. He notes that sweeping reforms in the 1990s have led to a much higher proportion of such workers than in most developed economies: a third of the workforce according to official data, and nearly half according to the unions. “I don’t agree that South Korea’s labour rules are rigid — it’s the other way around,” he says. “Jobs that used to be stable have now been converted to irregular ones.”

Tensions between unions and the state spilled into violence in November at Seoul’s biggest protest for years: demonstrators attacked police barricades with metal bars, while police used water cannon, knocking over an elderly farmer who has since been in a coma.

Following a visit to South Korea last month, UN special rapporteur Maina Kiai accused the government of “palpable . . . indifference towards the ability of workers to associate”, criticising its recent forcible dissolution of the teachers union. “I sense a trend of gradual regression on the rights to freedom of peaceful assembly and of association,” he wrote.

South Korea doesn’t have appropriate laws to protect temporary workers, and the government does not make employers comply even with the rules that are in place

– Kim Yoo-sun, Korea Labour & Society Institute

With time running out in the current parliamentary session, Ms Park has resorted to promoting a public petition campaign to urge lawmakers to pass the reforms. The Federation of Korean Industries, which represents large companies, has joined the drive, warning that its members would find it “impossible to create jobs for young people as long as the unfair labour law is kept as it is”. It added that the new laws would enable companies to scrap the traditional seniority-based pay system in favour of one based on performance, giving a fairer deal to young workers.

But critics dismiss such talk as cover for a move to perpetuate the “mass production” of irregular workers. “South Korea doesn’t have appropriate laws to protect temporary workers, and the government does not make employers comply even with the rules that are in place,” says Mr Kim, arguing that many employees remain on temporary contracts well beyond the legal time limit. “The government has closed its eyes to these people.”

Taiwan’s political landslide

Not trying to cause a big sensation

As much as anything, victory for Tsai Ing-wen and her party represents a generational change

Jan 23rd 2016 | TAIPEI | From the print edition

SHE had led in the opinion polls for Taiwan’s presidential election for months. Yet the margin of Tsai Ing-wen’s victory surprised many. She won 56% of the votes in a three-way race, with her chief contender, Eric Chu of the Nationalist Party or Kuomintang (KMT), trailing badly (see chart). Ms Tsai will become the island’s first female leader, while Mr Chu has already resigned as party chairman.

The outcome of the election to Taiwan’s parliament, the Legislative Yuan, was more striking still. Ms Tsai’s Democratic Progressive Party (DPP) won 68 of the 113 seats up for grabs, compared with only 35 for the KMT, which has lost its hold on the legislature for the first time since Chiang Kai-shek set up on the island in 1949. The KMT is now in the wilderness even if Ma Ying-jeou, president since 2008, limps on until Ms Tsai’s inauguration in faraway May.

Already, change is under way. An old guard of national and local figures who have dominated politics for years is shuffling off the stage. Such is the bad blood in the KMT that the prime minister, Mao Chi-kuo, rebuffed Mr Ma’s efforts to persuade him to stay on as caretaker—even leaving the president standing in the cold outside his home while refusing to meet him. Ms Tsai (pictured above with colleagues) says that her transition team will work closely with the KMT and others in the coming months. She is open to non-DPP politicians getting cabinet posts in areas where her party lacks expertise, like defence. But whether the political shock on January 16th can accommodate her promise of a consensual approach is unclear.

Across the country, the enthusiastic participation of younger and more liberal voters in the election has emphasised a sense of generational change. Activists from the Sunflower Movement of 2014 that opposed Mr Ma’s policy of strengthening economic ties with China are now fresh-minted politicians, accounting for the Legislative Yuan’s third-biggest grouping, the New Power Party. One of them is a front man of a heavy-metal rock group. It would have made old lawmakers’ black-dyed hair stand on end—had the election not pushed so many of them aside.

But at the crest of the wave is Ms Tsai. At 59, she is of an older generation than many of those who voted for her, and is not a natural guitarist, but she embodies a progressive spirit—supporting gay marriage, for instance. A former legal academic and trade expert, her somewhat mousy, low-key air seems to engender trust—and, no one doubts, conceals an iron will.

Above all she appealed by wanting to improve livelihoods. Her refrain was a message of generational equity: promising a fairer life for younger Taiwanese who struggle to afford housing, worry about job prospects and think that they will have to pick up the tab for a looming pensions crisis. Her call to boost energy from renewables while promising to make Taiwan nuclear-free within a decade appeals to those worried about the environment being at the mercy of the big energy firms. Yet Ms Tsai, who once helped negotiate Taiwan’s entry into the WTO, is not anti-business. In the face of diplomatic pressure from China, she wants Taiwan, with its huge export machine, to strike more trade deals. She has already announced that she will negotiate a free-trade pact with Japan. Membership of the American-led Trans-Pacific Partnership is also in her sights. Elsewhere, she says that Taiwan must find better ways to encourage innovation, including by removing the barriers to new businesses, and cut its reliance on contract manufacturing, amid cheaper competition elsewhere. A measure of Taiwan’s malaise is that the economy hardly grew last year.

Be careful what you wish for

It will be hard to turn things around quickly. Ms. Tsai’s plans for incentives to landlords to help provide 200,000 units of social housing are imaginative, and could boost growth. Restructuring industry to place more emphasis on design, marketing, logistics and services will prove much harder. Meanwhile, some of Ms. Tsai’s ideas appear questionable. Promising to go after assets that the KMT purloined following the defeat in 1945 of Taiwan’s Japanese overlords may make sense from the point of view of “transitional justice”. But it will hardly help engender the cross-party collaboration she says she seeks. As for scrapping nuclear power without thinking adequately about its replacement, it seems to promise a grave electricity shortage in the future—the kind of crisis that could scupper anyone’s presidency.

That kind of crisis aside, the hardest part of Ms. Tsai’s time in office is likely to be managing relations with China across the Taiwan Strait. Under Mr. Ma relations only improved, with 23 cross-strait economic agreements and, in November, an unexpected meeting between him and President Xi Jinping in Singapore. Yet stronger economic ties seemed to many Taiwanese not to benefit them, while the perceived secrecy of the negotiations engendered the Sunflower Movement.

Ms Tsai will be cooler on China—though not chilly. Mr Xi insists that China continue to endorse the so-called “1992 consensus”, in which China’s Communists and the KMT agreed there was but one China while differing on what that meant. Ms. Tsai has resisted endorsing the consensus. But she has rowed her party a long way back from its desire to declare formal independence—an act that would invite a military response against the island of 23m people. In her victory speech, she appealed to China’s leaders, emphasising that both countries should search for an acceptable way to interact “based on dignity and reciprocity”. She says she wants to “set aside differences” and build on the cross-strait dialogue to date. Probably, most Taiwanese approve, as does America, Taiwan’s protector. Now Ms Tsai’s unfiery manner must persuade China, too.

China’s P2P lending boom

Taking flight

The allure and the peril of Chinese fintech companies

Jan 23rd 2016 | SHANGHAI | From the print edition

ONE of the supposed virtues of peer-to-peer lenders—websites that connect borrowers to people with money to lend—is transparency. They often publish a range of information about those seeking loans (credit history, employment status, income), so that the investors stumping up the money know what they are getting into. So it is fitting that Imperial Investment, a Chinese P2P firm, is impressively transparent about its own circumstances. Earlier this month it published four separate notices from police, employees and family pleading for its runaway founder to return. “Our faces are bathed in tears,” the employees wrote.

Chinese media were far more phlegmatic about the woes of Imperial Investment, which has facilitated 935m yuan ($142m) in loans since its launch in 2013. “Runaway P2P bosses are no longer newsworthy,” declared the Jinling Evening News. At the end of 2015, nearly a third of all Chinese P2P lenders (1,263 out of 3,858) had run into difficulties, according to Online Lending House, an industry website. It classifies them according to the nature of their troubles: halted operations, disputes, frozen withdrawals or, as in the case of Imperial, bosses who have absconded. Running away may sound rather extreme but it turns out to be popular: 266 P2P bosses have fled over the past six months, by Online Lending House’s count. Although most of the firms in trouble are small, a few bigger ones have also come unstuck: Ezubao, China’s biggest P2P lender, which has arranged $11 billion-worth of loans, is one of the firms with frozen accounts.

Chinese P2P lenders’ many and varied problems might be expected to deter investors. Yet some of the bigger, better-run firms are still attracting serious money. In December Yirendai, the consumer arm of P2P lender CreditEase, became the first Chinese “fintech” firm to go public abroad, listing on the New York Stock Exchange with a valuation of around $585m. Earlier this month Lufax, a platform for a range of products including P2P loans, completed a fundraising round that valued it at $18.5 billion, setting it up for a keenly anticipated IPO. Both companies pride themselves on their risk controls.

Daily dispatches: China’s market mess

The optimistic scenario is that well-managed fintech firms will bring much-needed competition and efficiency to China’s sclerotic banking system, and profit handsomely while at it. The biggest lenders in China are mammoth state-owned banks, which tend to favor lending to state-owned enterprises over lending to private firms. That cedes plenty of space to P2P firms to build up their customer base and deliver credit to previously overlooked segments of the economy.

The worry, though, is that the sudden rush of money into P2P could push even good firms into bad lending decisions. Outstanding P2P credit rose more than tenfold over the past two years, from 31 billion yuan at the start of 2014 to 439 billion yuan at the end of last year. Average lending rates, meanwhile, fell from nearly 20% to 12.5%. Should inflows to P2P firms slow, lending rates will not be the only thing to spike higher: so too will the incidence of runaway bosses.

China to abstain from veto power at Asian Infrastructure Investment Bank

Bank president Jin Liqun said the practice would be a departure from policies at other institutions.

By Elizabeth Shim | Jan. 26, 2016 at 11:14 PM

China’s ceremonial flags fly in a stiff wind over Tiananmen Square in Beijing on March 8, 2015. China has been trying to build financial credibility as an economic powerhouse. Photo by Stephen Shaver/UPI

BEIJING, Jan. 26 (UPI) — China doesn’t plan to exercise veto power at the Beijing-led Asian Infrastructure Investment Bank, a departure from practices at institutions like the World Bank, where the United States has presiding influence on major policy decisions.

AIIB president Jin Liqun said the power of the vote would be shared among the 57-member countries, state-owned China Daily reported Wednesday, local time.

“There are still many countries on the waiting list, and when the new members join, China’s voting power will be reduced. Such de facto veto power will be lost gradually,” Jin said at the World Economic Forum in Davos last week.

The bank would instead retain a “fixed” special majority that are two-thirds of the number of members and equal to 75 percent of the voting power.

China currently holds less than 30 percent of voting or veto power.

Beijing has been trying to build financial credibility as an economic powerhouse, but the AIIB, which was signed into agreement last June, has been met with skepticism from rivals United States and Japan.

The two economies have declined to join the bank that plans to focus on building infrastructure that could bridge Europe and Asia, and provide financial support for projects in developing countries.

CNBC reported AIIB expects to lend $10-15 billion annually.

Russia, a bank member, is expected to lend $1 billion for various projects.

Why China poses the next great risk for a deflationary world

Ambrose Evans-Pritchard, The Telegraph | February 10, 2015 | Last Updated: Feb 10 1:20 PM ET

Getty Images A year of tight money from the People’s Bank and a $250-billion crackdown on shadow banking have together pushed the Chinese economy close to a debt-deflation crisis.

A year of tight money from the People’s Bank and a $250-billion crackdown on shadow banking have together pushed the Chinese economy close to a debt-deflation crisis.Haibin Zhu from JP Morgan says the 50 point cut in the RRR cut from 20% to 19.5% injects roughly $100-billion into the system.Yet the cut marks an inflexion point. There will undoubtedly be a long series of cuts before China sweats out its hangover from a $26 trillion credit boom. Debt has risen from 100% to 250% of GDP in eight years. By comparison, Japan’s credit growth in the cycle preceding its Lost Decade was 50% of GDP.Related

The People’s Bank may have to cut all the way to zero in the end — a $4 trillion reserve of emergency oxygen — but to do that is to play the last card.This will not itself change anything. The average one-year borrowing cost for Chinese companies has risen from zero to 5% in real terms over the last three years as a result of falling inflation. UBS said the debt-servicing burden for these firms has doubled from 7.5% to 15% of GDP.

The surprise cut in the Reserve Requirement Ratio — the main policy tool — comes in the nick of time. Factory gate deflation has reached 3.3%. The official gauge of manufacturing fell below the “boom-bust” line to 49.8 in January.China has edged out the West as the investment kingpin for the world — expect political influence to follow. China is trapped. The Communist authorities have discovered, like the Japanese in the early 1990s and the US in the inter-war years, that they cannot deflate a credit bubble safely.

The trigger was an amber warning sign in the jobs market. The employment component of the manufacturing survey contracted for the 15th month. Premier Li Keqiang targets jobs — not growth — and the labour market is looking faintly ominous for the first time.

Unemployment is supposed to be 4.1%, a make-believe figure. A joint study by the International Monetary Fund and the International Labour Federation said it is really 6.3%, high enough to cause sleepless nights for a one-party regime dependent on ever-rising prosperity to replace the lost elan of revolutionary Maoism.

Whether or not you call it a hard-landing, China is struggling. Home prices fell 4.3% in December. New floor space started has slumped 30% on a three-month basis. This packs a macro-economic punch.

A study by Jun Nie and Guangye Cao for the U.S. Federal Reserve said that since 1998 property investment in China has risen from 4% to 15% of GDP, the same level as in Spain at the peak of the “burbuja” — the country’s house price bubble. The inventory overhang has risen to 18 months compared to 5.8 in the US.

The property slump is turning into a fiscal squeeze since land sales make up 25% of local government money. Zhiwei Zhang from Deutsche Bank says land revenues crashed 21% in the fourth quarter of last year. “The decline of fiscal revenue is the top risk in China and will lead to a sharp slowdown,” he said.

The IMF says China’s fiscal deficit is nearly 10% of GDP once land sales are stripped out and all spending included, far higher than generally supposed. It warned two years ago that Beijing was running out of room and could ultimately face “a severe credit crunch.”

The gears are shifting across the Chinese policy spectrum. Shanghai Securities News reports that 14 Chinese provinces are preparing a $2.4 trillion blitz on infrastructure to combat the downturn.

How much of this is new money remains to be seen but there is no doubt that Beijing is blinking. It may be right to do so — given the choice of poisons — yet such a course stores up even greater problems for the future. The China Development Research Council, Li Keqiang’s brain-trust, has been shouting from the rooftops that the country must take its post-debt punishment “as soon possible”.

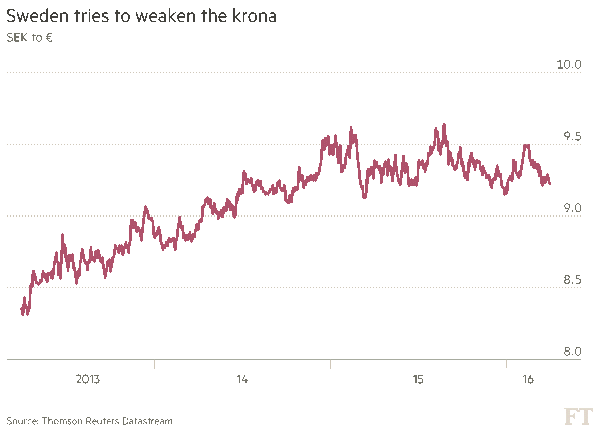

China is not alone in facing this dilemma as deflation spreads and beggar-thy-neighbour currency wars become the norm. Fifteen central banks have eased monetary policy so far this year.

Denmark’s National Bank has cut rates three times in two weeks to minus of 0.5% to defend its euro-peg, the latest casualty of the European Central Bank’s euros 1.1 trillion quantitative easing. The Swiss central bank has been blown away.

Asia is already in a currency cauldron, eerily like the onset of the 1998 crisis. The Japanese yen has fallen by half against the Chinese yuan since Abenomics burst upon the Pacific Rim. Japanese exporters pocketed the windfall gains of devaluation at first to boost margins. Now they are cutting prices to gain export share, exporting deflation.

China’s yuan is loosely pegged to a rocketing US dollar. Its trade-weighted exchange rate has jumped by 10% since July. This is eroding the wafer-thin profit margins of Chinese companies and tightening monetary conditions into the downturn.

David Woo from Bank of America says Beijing may be forced to join the currency wars to defend itself, even though this variant of the “Prisoner’s Dilemma” leaves everybody worse off. “We view a meaningful yuan devaluation as a major tail-risk for the global economy,” he said.

If this were to happen, it would send a deflationary impulse worldwide. China spent $5 trillion on fixed investment last year, more than Europe and America combined, increasing its overcapacity in everything from shipping, to steels, chemicals, and solar panels, to even more unmanageable levels. A yuan devaluation would dump this on everybody else. It would come at a moment when Europe is already in deflation at minus 0.6%, and when Britain and the U.S. are fast exhausting their inflation buffers as well.

Such a shock would be extremely hard to combat. Interest rates are already zero across the developed world. Five-year bond yields are negative in six European countries. These are no longer just 14th Century lows. They are unprecedented.

My own guess that we would have to tear up the script and start printing money to build roads, pay salaries, and fund a vast New Deal. This form of helicopter money or “fiscal dominance” may be dangerous, as dangerous as the alternative.

China faces a Morton’s Fork. Li Keqiang has made it his life’s mission to stop his country drifting into the middle income trap. He says himself that the investment-led model of last 30 years is obsolete. The low-hanging fruit of catch-up growth has been picked. China passed the point of no return five years ago.

Januaryfacing Vietnam as party meets

Michael Peel in Hanoi Financial Times @AFP

Vietnam’s ruling Communist party is preparing to select its next leaders at its five-yearly congress, amid tensions over China, the economy and the pace of political reform. The weeklong event in Hanoi offers a rare glimpse of the power struggles inside one of Southeast Asia’s largest countries and fastest-growing economies. Here are the big themes facing the country.

Not many people think the country is set for radical change. While internal battles are taking place, none of the likely new leaders is expected to push hard for greater freedom of speech, accelerated economic change or a love-in with China. Much of the smart money is on Nguyen Phu Trong, the party general secretary and one of a triumvirate of senior leaders, having his term extended by a year or two. An effort by one party faction to install Nguyen Tan Dung, prime minister for 10 years, as general secretary appears to be foundering — although the picture remains unclear. The third key figure is President Truong Tan Sang. However it plays out, there is little sign of a large injection of the youth that might better mirror the country’s populace.

Change needed

While the prime minister’s supporters say he is a reformist, pointing to greater freedom of speech, privatization, economic deregulation and better international ties, critics say he is given too much credit. Such public debate as exists is via social media rather than the government, which still detains dissidents often enough to remind people of the dangers of straying too far out of line. There is cronyism in business and privatization has been slow — the flagship Vietnam Airlines part-sale last year amounted in the end to just 5 per cent of the company and attracted little international interest (although Japan’s All Nippon Airways announced this month it was taking an 8.8 per cent stake).

International relations

Anti-China sentiment has grown so strong that it is hard for any politician to take a more accommodating line with Beijing, even if some would probably tone down the rhetoric of Mr Dung. The foreign ministry said this week it had raised concerns with China over its movement of an oil rig in a disputed area of the South China Sea — exactly the sort of clash that sparked anti-Chinese riots in some of Vietnam’s vast industrial zones in 2014. But Vietnam cannot afford to be too aggressive — it has a complex cultural and political relationship with China, by far its biggest trading partner. While Hanoi has been making some overtures to Washington, including high-level official visits each way, realpolitik and history mean it will never be in the western camp. Rather, Vietnam will probably try to use US links to persuade China to moderate its behavior.

Investment climate

With gross domestic product growth back above 6 per cent, Vietnam is benefiting from manufacturers relocating in a bid to cut costs after wage rises in countries such as Thailand and, particularly, China. But while the headline numbers and trends might look attractive to international investors, there is also a strong sense of unfinished business in Vietnam’s economy. These include bad loans at banks and enduring problems at big state companies. There are also fears the property bubble that led to a crash in the late “noughties” could be re-inflating again. The government has made a huge and still unproved bet on using generous perks to attract multinational companies such as Korea’s Samsung and Intel of the US to make Vietnam an export hub.

January 27, 2016 9:42 am

China’s economic leaders struggle to explain thinking to world

Tom Mitchell in Beijing and Gabriel Wildau in Shanghai Financial Times

Chinese regulator Fang Xinghai in Davos with Christine Lagarde, where he conceded Beijing has a messaging problem

Henry Kissinger’s famous question about the EU — “who do I call if I want to call Europe?” – now has a Chinese variant: who do investors turn to for guidance on Beijing’s monetary and currency policies?

Until recently, calls for clarity were met only by resounding silence, even as turmoil on China’s equity and currency markets reverberated around the world at the start of this month. While the government and central bank have since woken up to the fact they face a communications crisis, officials and analysts say the opacity of the Communist party makes it a difficult challenge to overcome.

Senior figures finally came out of their shells last week at the World Economic Forum in Davos to address their peers’ concerns about China’s management of its economy, markets and currency. Leading the charge was a good cop, bad cop team featuring Fang Xinghai, one of three vice-chairmen at China’s securities regulator, and Li Yuanchao, the country’s vice-president.

Both hold government positions that belie their real influence in China’s power structure. In addition to his post at the China Securities and Regulatory Commission, Mr. Fang is also affiliated with the party’s powerful Central Leading Group on Economic and Financial Affairs, where he is believed to have the ear of President Xi Jinping. Mr. Li, meanwhile, though ostensibly Mr. Xi’s number two, does not sit in the party’s inner sanctum — the seven-member Politburo Standing Committee.

Mr Fang is a Stanford-educated former World Bank official. Speaking on a panel with the likes of Christine Lagarde, head of the International Monetary Fund, he admitted that Chinese leaders needed to communicate better with global markets.

Mr. Li, meanwhile, attributed the renminbi recent volatility to market forces, which he said were reacting in part to the US Federal Reserve’s December interest rate rise. He also repeated the Chinese leadership’s longstanding assertion that it has “no intention to devalue its currency”.

Beijing’s critics say the belated appearance of two relatively unknown Chinese officials on a Swiss stage — while Premier Li Keqiang and central bank governor Zhou Xiaochuan maintained a steely silence back in the Chinese capital — is illustrative of the larger problem.

Messaging stumbles belie policy strides

China’s central bank has moved to jettison command-economy style mechanisms, write Tom Mitchell and Gabriel Wildau

“A lot of my clients thought they understood China,” says one Asian currency strategist. “They thought they knew what the [policy] framework was. But now they don’t understand who is making the decisions and why communication isn’t provided.

“They are increasingly becoming more disappointed with China,” the strategist added. “When the markets have no guidance they expect the worst.”

The People’s Bank of China’s defenders argue that the central bank does in fact provide good policy guidance — investors just have to comb through its publications or the state press to find it.

The communications problem stems in part from the fact that China’s central bank is technically an advisory body answerable to Premier Li’s State Council and does not enjoy the independence and power of the Fed or European Central Bank.

As a result, China lacks a Ben Bernanke or Mario Draghi type figure who can reassure markets in times of turmoil by pledging to do “whatever it takes”. Nor are other senior Chinese financial officials inclined to use the threat of a bazooka in their pocket, as Hank Paulson, former US Treasury secretary, did during the depths of the global financial crisis.

“Zhou Xiaochuan used to be quite active speaking but was heavily criticized for it,” says one Chinese financial policy expert, who asked not to be named. “Now poor Fang Xinghai is out there but in the wrong [government] position. The system doesn’t allow for an active PR posture.

“The PBoC has done a great job with its various reports but if you expect someone to go public, forget it,” he adds. “The premier likewise is in no position [to do so]. That’s not how the Chinese bureaucracy works.”

The central bank has, for example, published a detailed breakdown of the currency basket it now advises investors to benchmark the renminbi against, rather than the dollar. Confusion over this policy switch, announced in December, was blamed by many for this month’s market and currency turmoil.

One person who advises Chinese policymakers says the basket is an important tool as the renminbi transitions from a loose dollar peg system to a freely tradable currency, but he admits execution has not been perfect. “There is a strategy,” the adviser says. “It may not have been communicated very well but it is not stupid. They just need to be a lot clearer and make sure [the renminbi] is damn stable against the basket.”

Others argue that in terms of communication, the Chinese government and central bank are on the right path, albeit a long one. “Markets will always cry out for more and better information,” says Richard Yetsenga, head of ANZ Research in Sydney. “They will particularly cry for guidance when in a new regime and renminbi depreciation is new.”

“Some of the recent adjustments were not ideal,” adds Mr. Yetsenga, who believes investors have been “excessively bearish” on China. “But China is feeling its way and a bit of patience is called for.”

Moves to establish channels for dialogue

As part of the Chinese government’s efforts to improve communication with its global peers, Beijing officials conduct an annual Strategic and Economic Dialogue with their Washington counterparts.

On Wednesday, Nikkei reported that the Chinese and Japanese governments are also considering the launch of a “cabinet-level economic summit” in the coming months, which would provide a welcome change of focus from the two countries’ long-running disputes over historical issues and territory.

Beijing has established its most ambitious government-to-government exchange with Berlin — the two governments alternately host cabinet-wide meetings encompassing a full range of economic, financial and political matters.

More recently, former New York mayor Michael Bloomberg and US Treasury secretaries Timothy Geithner and Henry Paulson have established the Working Group on US Renminbi Trading and Clearing to promote financial links between the world’s two largest economies.

New York has trailed international rivals Hong Kong and London as a test bed for the internationalization of the renminbi.

Troubled manufacturing slows to weakest since 2012

Nathan VanderKlippe

BEIJING — The Globe and Mail

Published Monday, Feb. 01, 2016 5:14AM EST

Last updated Monday, Feb. 01, 2016 9:25AM EST

Trouble in China’s manufacturing industry continues, as new data show slowing output and rising layoffs, a further sign of the economic malaise affecting the world’s second-largest economy.

In China’s once-thriving factory regions, the New Year has brought more bad news, with plants shutting down, bankruptcy courts struggling to sell assets and confidence faltering.

The Caixin China General Manufacturing Purchasing Managers’ Index in January marked its 11th consecutive month in contraction territory, with a reading of 48.4. Anything below 50 is a signal for negative growth in the index, which offers a snapshot of manufacturing health.

The official Chinese PMI, at 49.4 in January, also indicated ongoing shrinkage in the sector that has been a key pillar of the country’s economy. Released Sunday, that figure was the weakest since 2012.

China’s economic signals are conflicting, with some bellwethers, like car sales, once again rising.

But the PMI data are among the first important Chinese economic indicators in 2016, and they offer little reason for hope after a rocky start to the new year. By midafternoon Monday in Asia, oil prices had fallen nearly 2 per cent, while Chinese markets also slipped more than 1 per cent and the yuan nudged downward. The Shenzhen and Shanghai composite indexes have both lost roughly a quarter of their value so far this year.

“The economy is still in the process of bottoming out and efforts to trim excess capacity are just starting to show results,” He Fan, chief economist at Caixin Insight Group, said in a statement. “The pressure on economic growth remains intense in light of continued global volatility.”

The Caixin data show stocks of finished goods continuing to rise and employment falling at the strongest pace in four months. Chinese manufacturers have now been in layoff mode for 27 months. The sector is nearing the year-long PMI contraction it saw in 2011 and 2012, its worst since the index was launched in 2004.

China went on “a debt binge” after the 2008 financial crisis, and “the process of working out debt problems and de-levering is unlikely to be resolved any time soon,” said Li Wei, director of the China Economy and Sustainable Development Center at the Cheung Kong Graduate School of Business.

He oversees the CKGSB Business Conditions Index, a different measure of corporate sentiment that in January came in at 51.2, a mark of only slight optimism (anything below 50 is pessimistic), that is down dramatically from 61.3 in May 2015.

Prof. Li also sits on several corporate boards in the midst of bankruptcy proceedings, “and for some of the assets that they are trying to unload in auction houses there has been no bidder. So all of this takes time,” he said. “We expect probably 2016 and well into parts of 2017 there won’t be much change in the way that China numbers are going to look.”

Chinese stock-market turmoil, in particular, is exacting a heavy toll on companies. Although much of the daily trading is conducted by at-home investors, they hold only about 40 per cent of shares. The remainder resides with governments and companies with large corporate cross-holding positions, some used as loan collateral.

Many firms in that situation now “have hit the point where there is a margin call on them,” Prof. Li said.

At the same time, the manufacturing sector “is struggling to transition away from overcapacity,” particularly in smokestack industries like cement, steel and coal, said Simon Gleave, a partner in the financial services practice at KPMG in Beijing.

But, he said, China is also “beginning to see some really positive signs in the economy.”

Take car sales which, after falling mid-year, rebounded strongly at year-end, rising 20 per cent in November. A significant tax cut helped move smaller-engined cars off lots, but in 2015 it was SUV sales that did best in China, up 52.4 per cent. The number of Chinese with driver’s licences is still rising at 12 per cent a year.

And while housing starts have now fallen for two years, housing prices were up 7.7 per cent in December, and China reached a record 7.3-trillion yuan ($1.55-billion Canadian) in nationwide home sales in 2015. Just over half of China’s major housing markets are now seeing rises in home prices, after 13 months of declines ended in October.

Here, too, there are underlying problems, including a staggering 13 million vacant homes – and recent buying has been propelled in part by government incentives.

But the price gains make it harder to predict the worst for China, Mr. Gleave said.

“I don’t see how you can have a hard landing if housing is picking up and car sales are picking up,” he said.

That’s not to say 2016 will bring much in the way of good times.

China is still “struggling very much” with poor-quality economic gains, Mr. Gleave said. Rather than chase long-term sustainable growth, “the government is trying to get eye-catching headlines that they’ve hit targets – but that gives you a very low return on capital investment.”

For now, China’s economy is “just bumping up and down a bit and we might get a few more knocks on the way.”

Follow Nathan VanderKlippe on Twitter: @nvanderklippe

February 29, 2016 3:04 pm

China injects cash to boost growth and counter capital outflows

Gabriel Wildau in Shanghai

©Bloomberg

China has moved to inject cash into its banking system in the latest effort by the government in Beijing to boost economic growth by ensuring the flow of low-cost credit from banks to corporate and household borrowers.

China recorded its weakest growth in a quarter of a century last year at 6.9 per cent and a further slowdown is expected this year. The G20 warned at the weekend of slowing growth and urged countries to strengthen policy support.

But economists said the decision by the People’s Bank of China to cut the required reserve ratio — or the share of customer deposits that banks must hold on reserve — by 0.5 percentage points risked putting downward pressure on the renminbi. The cut to the RRR will inject about Rmb690bn ($106bn) into the banking system, according to Financial Times estimates based on central bank data, and brings the ratio for big banks to 17 per cent.

“The aim [of the RRR cut] clearly is to support the economy at a time that downward pressures on growth remain strong and uncertainty is elevated,” Louis Kuijs, head of Asia economics at Oxford Economics, wrote on Monday.

“This move suggests that for China’s policymakers growth remains key.”

The latest cut brings the reduction of the RRR to two percentage points since last February. Monday’s cut was the first since October and marks a return by the PBoC to the policy tool which had been shelved in recent months in favour of open market operations, an alternative tool for managing the money supply.

The latest cut is also aimed at countering the impact on the money supply of large capital outflows in recent months and may also be intended to boost confidence in China’s stock market, which has renewed its falls, according to analysts.

China tremors

China roiled global markets last summer as its authoritarian leaders tried to stop a huge stock bubble from bursting and its slowing economy from stalling

In February the PBoC expanded its use of alternate tools to manage the money supply by increasing the frequency of open market operations. Open market operations, which inject cash into the banking system and have a similar impact to RRR adjustments, are considered more flexible because the size and duration of cash injections can be more finely calibrated.

A PBoC official had previously indicated that the central bank preferred to avoid further RRR cuts, a blunter instrument, due to concerns that they exacerbate renminbi weakness and capital outflows.

“It may be that the PBoC senses that speculative pressure has diminished or that closer monitoring of capital flows has helped slow the [outflow[s],” Mark Williams, China economist at Capital Economics, said in a note.

“Either way, today’s decision suggests the PBoC is more relaxed about outflows than a few weeks ago.”

The cuts are effective from March 1.

HSBC’s domicile dilemma

Asian dissuasion

Despite Britain’s bank-bashing mood, HSBC should stay in London

Feb 6th 2016 | From the print edition

LIKE many firms with roots in Hong Kong, HSBC has traditionally consulted a feng shui master on the design of its headquarters’ buildings. The bank’s dilemma today is more serious: in which country should its headquarters be? For the past year HSBC has debated moving its domicile, which in turn determines its tax base, lead regulator and lender of last resort.

One option is to stay in Britain, with its bank-bashers, latent hostility towards the City of London and ambivalence about Europe. The alternative is to move back to vibrant-but-riskier Hong Kong, where HSBC was founded 151 years ago and was based until the 1990s. It is not an easy choice, but in the end pub grub and stability trump dim sum and political uncertainty.

HSBC matters. Regulators judge it to be the world’s most important bank, alongside JPMorgan Chase. A tenth of global trade passes through its systems and it has deep links with Asia. (Simon Robertson, a director of the bank, is also on the board of The Economist Group.) Its record has blemishes—most notably, weak money-laundering controls in Mexico. But it has never been bailed out; indeed, it supplied liquidity to the financial system in 2008-09. It is organized in self-reliant silos, a structure regulators now say is best practice.

For Britain, the departure of its best bank would be perverse (if only it could deport Royal Bank of Scotland instead). But HSBC is fed up with Blighty. A levy charged on its global balance-sheet cost 10% of last year’s profits; rules on ring-fencing its retail arm will cost $2 billion. Both are meant to protect Britain from global banks blowing up, but they duplicate other measures aimed at the same problem—silos, capital surcharges, “bail-in” bonds and liquidity buffers. Britain says it will lower the levy. But over time Asia, which accounts for 60% of the bank’s profits, will grow faster than Britain, and so HSBC will too. The tension between HSBC’s ambitions and Britain’s suspicion of giant banks is not going away.

Hong Kong is keen for the bank’s return, which would boost confidence after a torrid time for Chinese markets. HSBC’s biggest subsidiary is already based in the territory and supervised by the Hong Kong Monetary Authority (HKMA), its impressive regulator. By moving, HSBC would not ease its tax bill or capital levels by much. But it would avoid the levy, butt heads with Western regulators less and be closer to its biggest markets.

From a dirty old river to a fragrant harbour

Time to pack the bags? One objection is that HSBC is already thriving in greater China: it does not need to be domiciled there to succeed. Nor would moving to Hong Kong insulate HSBC from a British exit from the European Union. But the biggest worry is that Hong Kong is small and a territory, not a country. The HKMA has $360 billion of foreign reserves but it lacks the crisis toolkit of a central bank. It cannot print an infinite amount of money without undermining its currency peg and it lacks a credit line from America’s Federal Reserve to supply it with dollars, HSBC’s operating currency.

With a balance-sheet nine times bigger than Hong Kong’s GDP, HSBC’s ultimate backstop would be mainland China’s government, whose approach to finance is as transparent as Victoria Harbour. That might deter some customers. It would also annoy America, which might not be keen on HSBC playing a big role in the dollar-clearing system, a privilege that is vital for HSBC’s business. For an Asia-centric bank to be based in London is an anomaly. But, for now, one worth keeping.

Outflows from China top $110bn in January

Shawn Donnan in Washington

©Bloomberg

Chinese companies and residents sent more than $110bn out of the country in January alone, according to new estimates, as they continued to evade tightening capital controls amid another round of market turmoil.

Surging capital outflows from China have become a source of growing concern around the world and left Beijing scrambling to support its currency. Recently-released data showed the country’s foreign exchange reserves falling to their lowest level in almost four years in January.

Be briefed before breakfast in Asia – our new early-morning round-up of the global stories you need to know

In the first significant attempt to digest the capital flight amid January’s market turmoil in China, the Institute for International Finance estimated that $113bn had been sent out of the country in the month.

That was more than in any month bar two in 2015, when it estimated a total of $637bn left China, down slightly from the estimate of $676bn it released last month. It also marked the 22nd month in a row of net outflows.

The IIF is a Washington-based industry group that represents banks and insurers around the world. Its estimates are based on extrapolations from official Chinese data and it cautioned that its January figures amounted to only “an approximation of the magnitude of capital flows”.

But the IIF’s figures shine a light on the extent of capital flight as they endeavour to capture funds leaving the country through unofficial channels, such as over-invoicing for exports and other methods used to circumvent official capital controls.

“If anything, it looks too low,” said Mansoor Mohi-uddin, senior market strategist at RBS in Singapore, referring to the IIF’s estimate for January. “With FX reserves falling at $100bn a month it appears increasingly likely the central bank will allow the [renminbi] to slide lower again towards 7.00 against the dollar.”

The IIF’s economists said that, based on recently-released official reserve data, they estimated that the Chinese government had spent $90bn intervening to prop up its currency in January.

Those interventions by the People’s Bank of China represented more than a quarter of the $342bn it spent in all of last year in response to outflows, the IIF said.

However, Beijing remains reluctant to appear to crack down too much on capital outflows, said Zhou Hao, senior economist for Asia at Commerzbank AG in Singapore. Tightening “could have a negative impact on people’s mindset. It could encourage more capital outflows because people would think something is wrong.”

Video After the sudden closure of a shoe factory, a migrant worker on China’s eastern seaboard heads back to his home in the countryside. China’s shoe industry has been hit hard by the slowing economy.

By NEIL GOUGH

January 19, 2016

DONGGUAN, China — Walking around an abandoned furniture factory, Fang Minghua pointed out the workshops where several hundred employees once toiled, transforming sheets of raw wood into TV stands or wardrobes for the aspiring middle class in China and other emerging economies.

The factory is relocating to a new facility two hours away, priced out by rising costs and falling orders. Mr. Fang estimated that as many as a third of the furniture factories around town had gone out of business, while many others were struggling.

“The economic slowdown is real,” said Mr. Fang, 46, who over the last 22 years had worked his way up from $50-a-month laborer to production supervisor.

The downturn in Dongguan, a once-thriving manufacturing hub, is part of the Chinese economic puzzle that global investors are trying to solve.

Graphic | Why China Is Rattling the World China’s economy is faltering, prompting concerns that are now shaking global stock markets.

While China has been moving away from the type of low-end manufacturing that has been Dongguan’s specialty, the protracted slump in the country’s vast industrial sector is a major threat to the nation’s already slowing economy. As the government tries to manage the situation, the risk is that the Chinese economy is worse off than expected — a concern that has put markets around the world on edge.

The latest signals from China don’t offer much reassurance, as the economic weakness shows little sign of abating. On Tuesday, China reported growth of just 6.8 percent for the fourth quarter, its slowest expansion since the depths of the financial crisis in 2009.

For the full year, China expanded at 6.9 percent, just below the government’s target of 7 percent and the weakest performance since 1990 when foreign investment shriveled in the year after the deadly crackdown in Tiananmen Square.

When it comes to the economy, Mr. Fang said, politicians and business leaders talk about industrial innovation and upgrading, “but I think that is just a slogan. It’s really hard to carry out.”

Lam Yik Fei for The New York Times

Dongguan is at the heart of south China’s Pearl River Delta. For decades, the region drove the country’s global ascent in exports, producing furniture, garments, shoes and other goods.

But the world’s workshop has been stumbling as cheaper production bases in Asia have gained ground. Last year, Chinese exports fell for the first time since the financial crisis — and for only the second time since the country’s economy began reopening to the outside world in the late 1970s.

That position is likely to be further eroded by the Trans-Pacific Partnership. The United States-led trade agreement deepens American ties with Asian countries like Vietnam and Malaysia, but it excludes China.

The slump has created a tricky situation for the government.

A shoe vendor’s banner says “Financial Crisis, Want money instead of goods.” Many workshops in Dougguan, China, have closed; others have moved in search of cheaper rent and labor.

Lam Yik Fei for The New York Times

Officials have encouraged phasing out low-end exports in favor of promoting the service sector and high-tech manufacturing. While newer and more dynamic companies are on the rise in China, the risk is that they won’t develop fast enough to offset the hollowing out of light manufacturing, which remains a shrinking but significant employer across the country.

Some traditional manufacturers have responded to the downturn by relocating farther inland or overseas, where costs are generally lower. Others are trying to reduce their reliance on export orders by establishing their own branded products for domestic sale.

“This is an unfortunate pain being felt in traditional, older sectors,” said Louis Kuijs, the head of Asia economics at Oxford Economics. However, he added, the shift away from low-end, labor-intensive manufacturing “is an unavoidable part of the structural change that the economy is undergoing.”

Zhang Lin, 43, is trying to adapt to the shifting terrain.

Workers walk past notices listing factory space for rent in Dongguan, a once thriving manufacturing hub.

Lam Yik Fei for The New York Times

As a supervisor, Mr. Zhang, who left his home in western Sichuan Province 25 years ago to work in Dongguan shoe factories, once oversaw about 7,000 production-line workers at a Taiwanese-owned factory here. At their peak, before the financial crisis, factories in the city accounted for about one in every four pairs of athletic shoes sold globally, according to estimates from the Dongguan Shoe Industry Commerce Association.

But rising costs have weighed heavily on the shoemaking business. The Taiwanese factory where Mr. Zhang worked closed in 2012. He and several partners went out on their own, setting up a plant making shoes and leather boots for brands like K-Swiss and Durango. Today, Mr. Zhang’s factory employs about 700 people.

While costs are rising, demand from overseas customers has also been declining. The company’s orders slipped to about 1.2 million pairs of shoes last year, down about 15 percent from 2014.

“It’s hard to say whether we can keep going for another five years — the outlook isn’t very good,” Mr. Zhang said.

In response, the company has been reducing hours for its workers. It also considered moving.

While the company plans to keep the existing factory here, it is making a future bet by expanding to a less-developed province, Guizhou. Labor costs there are as much as 40 percent less than those in Dongguan. Mr. Zhang also went on a scouting trip in August to Bangladesh, where some other large Dongguan shoe companies have shifted production.

The factory has also started making its own line of leather casual shoes. It sells them online in China, for as much as $75 a pair, on Taobao, Alibaba’s main online shopping platform.

“In a situation where overseas orders are falling, you need to have a backup plan,” Mr. Zhang said.

Other sectors have similarly been struggling, including some electronics manufacturers. In October, Fu Chang Electronic Technology, a supplier to the telecommunications equipment makers Huawei and ZTE, shut its doors unexpectedly. The closing prompted a protest by thousands of workers in front of a government building in Shenzhen.

Chinese officials, wary of further labor unrest, have sought to ease pressures on the sector. Earlier this month, one of China’s main tech regulators said it would team up with a big local bank to set up a $30 billion fund to support troubled small and medium-size electronics suppliers.

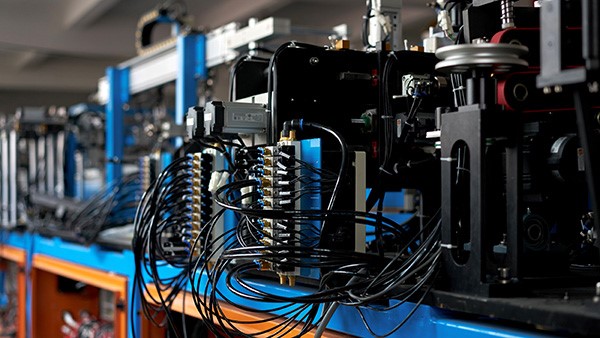

While there are still many active factories in Dongguan, the main ones succeeding are increasingly high-tech and less reliant on large staffs.

After working 15 years at an automotive plant in Alabama, Michael Recha moved to Dongguan in 2012 to set up a specialized factory for car parts, one of the first of its kind in China. Owned by Gestamp, a Spanish automotive component maker, the factory uses a technology called hot stamping to form metal sheets into precision parts like car bumpers and body panels for both local and foreign carmakers.

But robots do an increasing share of the work. The factory employs just 400 workers working two shifts a day.

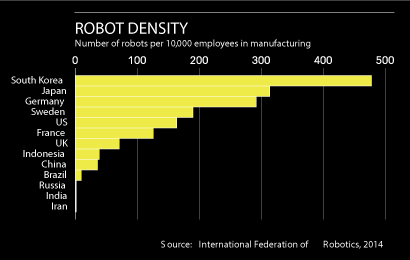

“China is no longer a low-cost country, so we have the same robots and equipment here” as in Europe, Mr. Recha said.

Mr. Fang, of the furniture factory, estimates that by moving inland and consolidating three factories, the company saves about $150,000 a month in operating costs — including lower electricity and water bills, and also taxes. The biggest saving is on rent, because the owner of the company was able to buy low-cost land to build the new compound.

The move, though, has extracted a different toll.The new factory is relatively remote, so there isn’t much to do after work. Mr. Fang’s wife, who stayed behind in Dongguan, “doesn’t feel very happy about being apart,” he said. Their current plan is for her to join him sometime after next month’s Lunar New Year holiday.“She will get a new job, probably in the same factory with me,” he said.

Sarah Li contributed research.

China’s excess industrial capacity harms its economy and riles its trading partners

Feb 27th 2016 | SHANGHAI |

“OVERSUPPLY is a global problem and a global problem requires collaborative efforts by all countries.” Those defiant words were uttered by Gao Hucheng, China’s minister of commerce, at a press conference held on February 23rd in Beijing. Mr. Gao was responding to the worldwide backlash against the rising tide of Chinese industrial exports, by suggesting that everyone is to blame.

Oversupply is indeed a global problem, but not quite in the way Mr. Gao implies. China’s huge exports of industrial goods are flooding markets everywhere, contributing to deflationary pressures and threatening producers worldwide. If this oversupply were broadly the result of capacity gluts in many countries, then Mr. Gao would be right that China should not be singled out. But this is not the case.

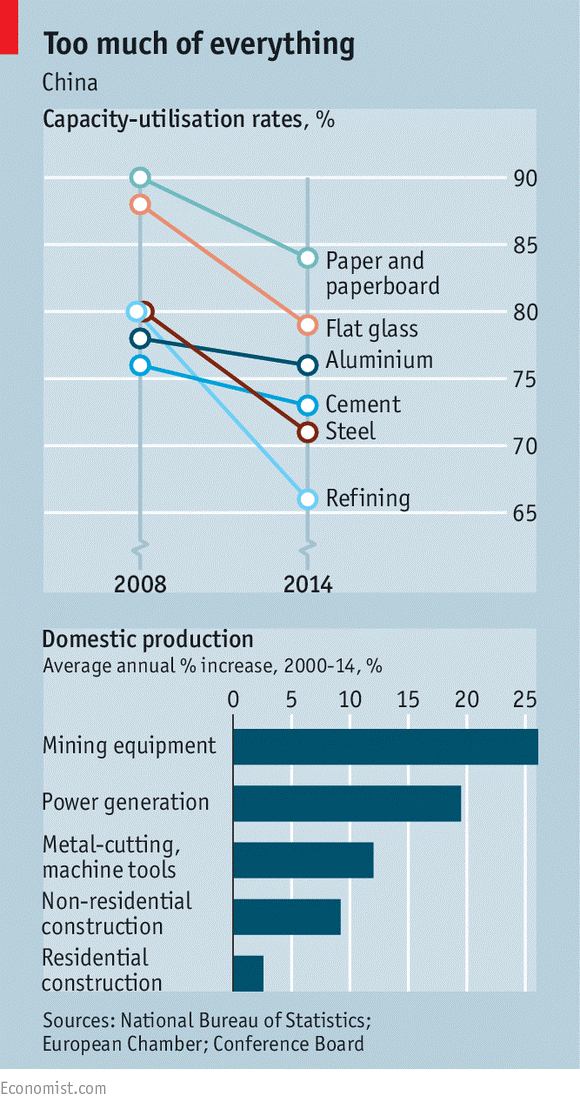

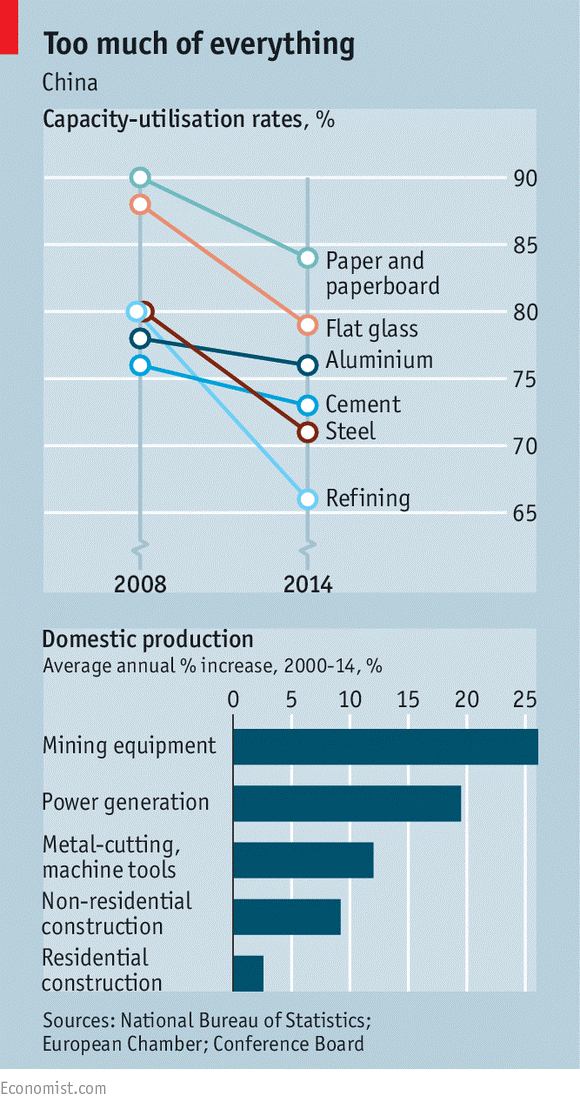

China’s surplus capacity in steelmaking, for example, is bigger than the entire steel production of Japan, America and Germany combined. Rhodium Group, a consulting firm, calculates that global steel production rose by 57% in the decade to 2014, with Chinese mills making up 91% of this increase. In industry after industry, from paper to ships to glass, the picture is the same: China now has far too much supply in the face of shrinking internal demand. Yet still the expansion continues: China’s aluminum-smelting capacity is set to rise by another tenth this year. According to Ying Wang of Fitch, a credit-rating agency, around two billion tonnes of gross new capacity in coal mining will open in China in the next two years.

A detailed report released this week by the European Union Chamber of Commerce in China reveals that industrial overcapacity has surged since 2008 (see charts). China’s central bank recently surveyed 696 industrial firms in Jiangsu, a coastal province full of factories, and found that capacity utilisation had “decreased remarkably”. Louis Kuijs of Oxford Economics, a research outfit, calculates that the “output gap”—between production and capacity—for Chinese industry as a whole was zero in 2007; by 2015, it was 13.1% for industry overall, and much higher for heavy industry.

Scarier than ghosts

Much has been made of China’s property bubble in recent years, with shrill exposés of “ghost cities”. There has been excessive investment in property in places, but many of the supposedly empty cities do eventually fill up. China’s grotesque overinvestment in industrial goods is a far bigger problem. Analysis by Janet Hao of the Conference Board, a research group, shows that investment growth in the manufacture of mining equipment and other industrial kit far outpaced that in property from 2000 to 2014. This binge has left many state-owned firms vulnerable to slowdown, turning them into profitless zombies.

Chinese industrial firms last year posted their first annual decline in aggregate profits since 2000. Deutsche Bank estimates that a third of the companies that are taking on more debt to cover existing loan repayments are in industries with overcapacity. Returns on assets of state firms, which dominate heavy industry, are a third those seen at private firms, and half those of foreign-owned firms in China.

The roots of this mess lie in China’s response to the financial crisis in 2008. Officials shovelled money indiscriminately at state firms in infrastructure and heavy industry. The resulting overcapacity creates even bigger headaches for China than for the rest of the world. The overhang is helping to push producer prices remorselessly downward: January saw their 47th consecutive month of declines. Falling output prices add to the pressure on debt-laden state firms.

The good news is that the Chinese have publicly recognized there is a problem. The ruling State Council recently declared dealing with overcapacity to be a national priority. On February 25th the State-Owned Assets Supervision and Administration Commission, which oversees big firms owned by the central government, and several other official bodies said they would soon push ahead with various trial reforms of state enterprises. The bad news is that three of the tacks they are trying only make things worse.

One option is for China’s zombies to export their overcapacity. But even if the Chinese keep their promises not to devalue the yuan further, the flood of cheap goods onto foreign markets has already exacerbated trade frictions. The American government has imposed countervailing duties and tariffs on a variety of Chinese imports. India is alarmed at its rising trade gap with China. Protesters against Chinese imports clogged the streets of Brussels in February. There is also pressure for the European Union to deny China the status of “market economy”, which its government says it is entitled to after 15 years as a World Trade Organisation member, and which would make it harder to pursue claims of Chinese dumping.

Another approach is to keep stimulating domestic demand with credit. In January the government’s broadest measure of credit grew at its fastest rate in nearly a year: Chinese banks extended $385 billion of new loans, a record. But borrowing more as profits dive will only worsen the eventual reckoning for zombie firms.

A third policy is to encourage consolidation among state firms. Some mergers have happened—in areas such as shipping and rail equipment. But there is little evidence of capacity being taken out as a result. Chinese leaders are dancing around the obvious solutions—stopping the flow of cheap credit and subsidized water and energy to state firms; making them pay proper dividends rather than using any spare cash to expand further; and, above all, closing down unviable firms.

That outcome is opposed by provincial officials, who control most of the country’s 150,000 or so publicly owned firms. Local governments are funded in part by company taxes, so party officials are reluctant to shut down local firms no matter how inefficient or unprofitable. They are also afraid of the risk of social unrest arising from mass sackings.

China’s 33 province-level administrations are at least as fractious as the European Union’s 28 member states, jokes Jörg Wuttke, head of the EU Chamber: “On this issue, increasingly Beijing feels like it’s Brussels.” So Mr. Gao’s claim that the problem is not entirely his government’s fault may be true in a sense. But in the 1990s China’s leaders did manage bold state-enterprise reforms involving bankruptcies and capacity cuts, that overcame such vested interests. To meet today’s concerns, the central government could provide more generous funding to local governments to offset the loss of tax revenues arising from bankruptcies, and also strengthen unemployment benefits for affected workers.

If China’s current leaders have the courage to implement such policies, there may even be a silver lining. Stephen Shih of Bain, another consulting firm, argues that much quiet modernization “has been masked in many industries by overcapacity”. For example, little of the fertilizer industry’s capacity used advanced technologies in 2011; most of the new capacity added since then has been the modern sort that is 40% cheaper to operate.

Baosteel Group, a giant state-owned firm, has been forced by Shanghai’s local authorities to shut down dirty old mills in the gleaming city. So its bosses have built a gargantuan new complex in Guangdong province with nearly 9m tonnes of capacity. This highly efficient facility has cutting-edge green technologies that greatly reduce emissions of Sulphur dioxide and nitrogen oxides, recycle waste gas from blast furnaces and reuse almost all wastewater. “When the older capacity in China is shut down, we’ll have a much more modern industrial sector,” Mr. Shih says. “The question is, how long will this take?”

TPP deal signed, but years of negotiations still to come

Rebecca Howard