Canada

Airbnb likely removed 31,000 homes from Canada’s rental market, study finds

Short-term rental sites are ‘having rather large impacts on our housing markets,’ McGill researchers say in ground-breaking paper

More than 31,000 homes across the country were rented out so often on Airbnb in 2018 that they were likely removed from the long-term rental supply, according to a ground-breaking study by McGill University researchers.

Put another way, that’s more than enough homes for everyone in North Vancouver.

As the popularity of short-term rentals has soared, the effect on rental supply in Canada’s cities, towns and rural areas has grown, according to the study. Shared exclusively with The Globe and Mail, the report is the most comprehensive analysis of Airbnb’s impact to date, and reveals the extent of the global rental service’s footprint, even as local officials implement rules that target the short-term rental industry.

How small Canadian towns are grappling with Airbnb’s explosive growth

Those 31,000 homes are equal to about 1.5 per cent of residences across the country that have been built for the rental market.

Airbnb and similar platforms are among several factors, including a lack of rental construction and high barriers to home ownership, that have affected rental markets. Housing advocates say not enough rental housing is being built in Canada’s largest cities to accommodate population growth.

In 2018, the platform had a daily average of 128,000 active listings in Canada, which includes everything from a basement suite to a lakefront cottage, an increase of 25 per cent from 2017, according to the report. And for hosts, it’s been a profitable time: They brought in $1.8-billion in revenue last year, up 40 per cent from 2017.

“Many people believe that they interact with these services mainly as guests,” said David Wachsmuth, a McGill professor and one of the report’s co-authors. “What my research has been showing is that, actually, we interact with short-term rentals every day of our lives in a different way – they’re having rather large impacts on our housing markets.”

In the past, Prof. Wachsmuth has done consulting work and produced reports for governments, and civic and business groups, including a hotel-industry association. This study, which has been peer reviewed, was funded solely by the federal government, however.

David Wachsmuth , Canada Research Chair in Urban Governance, poses in Le Plateau, a neighborhood where Airbnb’s are becoming more prevalent, in Montreal, on June 14, 2019.

Christinne Muschi/The Globe and Mail

Over the past decade, short-term rentals have become increasingly popular. Sites such as Airbnb, HomeAway and VRBO have developed into global platforms, allowing people to rent out spare rooms or entire homes to travellers, with a cut going to the company.

“When you offer your place as a short-term rental, you have more control over it, you can use it for yourself whenever you want, [and] it makes more money” than renting to long-term tenants, said Dany Papineau, who operates four listings at two properties he co-owns, one in Montreal and another in the Eastern Townships, about 90 minutes east of the city. “Personally, I’m not interested in doing long-term rentals at all,” he said.

As short-term rental activity has grown globally, regulators in many of the world’s tourist hubs – Barcelona, New York, Amsterdam, Los Angeles – are cracking down on short-term rentals, citing concerns over distortions to the local housing supply and lost tax revenue, along with a host of other issues.

In New York, for instance, Airbnb directly accounted for a US$380 increase in median annual rent costs, according to a separate report from Prof. Wachsmuth last year that was funded, in part, by a hotel-industry organization. “The more Airbnb activity you see in a city, the higher housing prices and the higher rents are going to get,” he said. “There’s no question that [Canadian] cities are now past that point.”

Within Canada, short-term rental activity is highly concentrated in a few cities. The Montreal, Toronto and Vancouver areas accounted for close to half of Canada’s average daily listings in 2018, and hosts there brought in $710 million, up 27 per cent from 2017. They’re also where the most rental supply is under threat: Forty per cent of the roughly 31,000 homes that were frequently rented last year were found in those cities, amounting to more than 12,000 “lost”

“It’s a relatively significant number,” said Graham Haines, research manager at the Ryerson City Building Institute, of the total number of frequently rented homes. Between the Montreal, Toronto and Vancouver areas, “that’s almost enough housing to add a whole percentage point back onto our vacancy rates,” he added.

Vacancy rates for purpose-built apartments in the Montreal, Toronto and Vancouver areas were 1.9 per cent, 1.1 per cent and 1 per cent, respectively, in 2018, according to the Canada Mortgage and Housing Corp. – all below historical norms. Over the past five years, Toronto has added 18 times more condominium units (80,000) than purpose-built rentals (4,500 units), according to a city report from January.

When asked about the study’s findings, Airbnb said it takes housing affordability seriously. “In Canadian cities such as Toronto and Vancouver, there’s no question they’re facing real housing challenges,” said Alex Dagg, director of public policy at Airbnb Canada.

Ms. Dagg contested the McGill team’s findings, saying they are based only on publicly accessible information collected from Airbnb’s website. For instance, she said that when an Airbnb unit is unavailable for bookings, researchers would be unable to fully ascertain whether it is occupied by its owner rather than a guest.

“We don’t agree with the validity of that number,” Ms. Dagg said of the report’s finding that 31,000 homes were frequently rented. She also disagreed that Airbnb was having an impact on rental housing. “[They have] no way of knowing those houses or those units would ever be on the long-term rental market,” she said.

To calculate lost housing numbers, the McGill team looked for entire-home listings available for rent at least half the year and rented at least 90 nights. According to the study, any home that’s listed for most of the year likely doesn’t house a long-term resident.

“There are people who are being evicted from their apartment buildings to convert those units into Airbnb’s,” Prof. Wachsmuth said. “That’s a fact right now.”

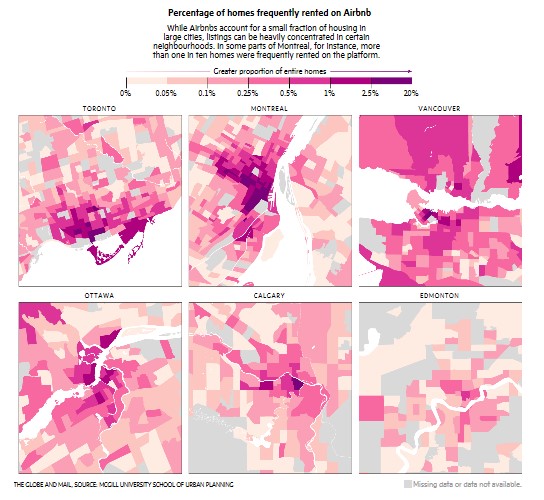

The McGill authors note that frequently rented homes “are still a small fraction of total housing” in any Canadian city. However, listings can be highly concentrated in some neighborhoods. In parts of Montreal, for instance, one in five homes were listed on Airbnb.

As short-term rental platforms continue to grow, policymakers have started to respond.

In 2016, Quebec became the first major Canadian jurisdiction to regulate the short-term rental industry, requiring some hosts to obtain permits. Vancouver’s rules went into effect last year, and only allow short-term rentals in a host’s principal residence. Toronto has passed its own regime, although zoning amendments are tied up in appeals proceedings, with a hearing set for August.

Enforcement has proved tricky, however. In the early days of Quebec’s regulations, virtually no hosts were complying, Prof. Wachsmuth said. The province later shifted enforcement to its revenue department, giving it expanded powers to target wrongdoers. Still, just two weeks ago, Quebec overhauled its rules again.

“We’ll find them, and we’ll fine them,” Tourism Minister Caroline Proulx said of rule-breaking hosts.

Despite provincial regulations, Airbnb has continued rapidly growing in Montreal, fuelled by the outsize impact of another nationwide trend: the rise of hyperactive, professional hosts who manage several listings.

Nearly half of all Canadian Airbnb revenue in 2018 was generated by commercial operators, or those who manage multiple listings, the McGill report said. Their share of sales increased from 2017 in nearly all metro areas. Among this group, there are some hosts that vastly eclipse the competition: Fifteen managed at least 100 active listings apiece in the past year, the report said, and nearly 60 hosts earned more than $1 million in 2018.

“Canadian cities really stand out when you look around the world, for having their short-term rental market dominated by commercial operators,” said Prof. Wachsmuth, whose team has established itself as world leaders in measuring the global impact of Airbnb. “Montreal in particular is the worst in the whole world.”

It vastly differs from how Airbnb often pitches itself: as a personal platform through which residents, either out of town or looking to put a second bedroom to good use, will occasionally rent out their spaces.

Often, the largest “hosts” are in fact businesses that manage vacation rentals on behalf of homeowners. That’s the case for Maryrose Coleman and Ross Halloran, who together run Muskoka District Rentals, a cottage-rental service. They conduct roughly a third of their business on Airbnb.

Listing your place on Airbnb can land you in trouble with your mortgage lender

In Muskoka, Ont., a cottage can easily sell for upward of $2-million, even though it may only be occupied for a few weeks out of the year. These days, if you have a cottage, Mr. Halloran said, “it’s good business to rent it out – mitigate the costs, if you can, when you’re not using it.”

Data from the McGill team suggest Muskoka District Rentals is among the largest Airbnb hosts by revenue. As of mid-June, it had 76 listings on the platform.

Back in Montreal, more than 30 per cent of the city’s Airbnb revenue was generated by 1 per cent of hosts in 2018, and many link the rise of commercialization to lost housing supply.

City councillor Richard Ryan estimates that “a couple of thousand units” in the city’s central areas were lost to commercial operators. He was a driving force behind new bylaws in the Plateau-Mont-Royal and Ville-Marie boroughs, where listings can be restricted to particular streets.

Beyond questions over supply, short-term rentals are roiling communities in other ways. “These issues are significantly affecting the quality of life in the neighbourhood: noise, parties at any time of day or night, safety concerns, garbage strewn out on the street, a lack of respect for neighbours and so on,” Mr. Ryan said via e-mail.

Even with new regulations in place, there remain broad swaths of the country – from big cities such as Calgary, to small communities in Ontario’s cottage country – where short-term rentals are subject to few restrictions, if any at all. As such, Prof. Wachsmuth expects Airbnb to continue growing, given that Canada is less of a mature market than the United States.

Even then, he is near certain his research is still underestimating the size of the short-term rental market in Canada. But he notes that the Canadian market has hit a turning point.

“Airbnb, HomeAway and other companies in the sector enjoyed a period of several years where policy-makers weren’t really paying attention,” he said. “I think that period is over now

December 5, 2018 by On-Site Staff

Between trade battles over steel and aluminum tariffs and halts to major projects such as the Trans Mountain Pipeline, Canada needs to ensure investors still see it as a safe bet

There is no shortage of changes, both positive and negative, the industry faces as 2018 comes to a close.

On-Site caught up with Mary Van Buren, the president of the Canadian Construction Association, to discuss the trends the industry association will be watching closest over the next 12 months. For a more in-depth look, you can read through our 2019 Canadian construction forecast here.

But without further ado, here are the 10 items that should be on every Canadian construction firm’s laundry list in 2019:

1 — Confidence in Canada

Approval issues for major projects and Canada’s relative tax disadvantage versus the U.S. could cause trouble for builders as investors think twice about their Canadian spending.

2 — Competition for talent

Despite near-record employment and a strong economy, the industry faces a significant challenge from an impending wave of retirements and competition for the next generation of talent.

3 — Inclusive workplaces

The construction industry has worked hard to better integrate women and First Nations on job sites. While attracting new recruits remains tough, companies are also shifting their focus beyond diversity and pursuing more inclusive, flexible workplaces.

4 — Social procurement

The federal government has tied social policy into its $180 billion infrastructure plan through, among other strategies, community employment benefits. It’s a trend the CCA expects to continue.

5 — Millennial leadership

Boomers are retiring and family-owned businesses are being passed down to sons and daughters. The culture of construction is certain to change as tech-savvy Millennials take the reins.

The industry continues to reach new heights, but adopting innovative new approaches will ensure growth continues

6 — Pay to play

Building new and repairing aging infrastructure isn’t cheap. Institutions such as the Canada Infrastructure Bank, as well as tools like toll roads, are expected to play a larger role as investors look for revenue streams.

7 — Innovation

Industry players are expected to step up their efforts to leverage new partnerships and technologies in 2019. Ultimately, these new solutions should solve long-standing industry problems.

8 — Privacy

Smart cities, smart roads and related data-gathering technologies are expected to become increasingly important. Keeping the data under wraps and collecting it with permission will prove a challenge.

9 — Productivity

Technology and innovation will continue to help the sector improve productivity, while embracing new strategies, such as accelerated capital depreciation for equipment, could also be beneficial.

10 — Trade war and trade woes

Canada, Mexico and the U.S. finally agreed to a new trade deal, but the months-long battle along with steel and aluminum tariffs should have companies looking for non-traditional suppliers.

This article originally appeared in the December 2018 issue of On-Site. You can read through the complete issue here.

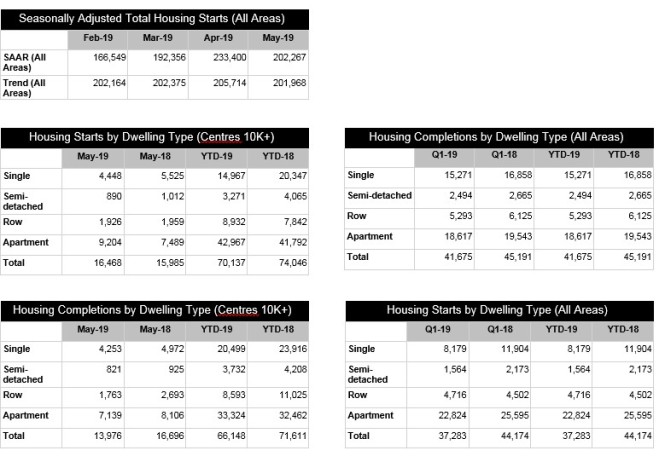

Source: CMHC Starts and Completions Survey / Market Absorption Survey Notes:

Seasonally adjusted annual rates (SAAR) are monthly figures adjusted to remove normal seasonal variation and multiplied by 12 to reflect annual levels. The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR).

Year-to-Date (YTD) numbers are calculated using the sum of the individual months. There may be slight differences due to rounding when these are compared to quarterly or annual data in other CMHC tables or publications.

For more detailed definitions, please see refer to: https://www03.cmhc-schl.gc.ca/hmiportal/en/TableMapChart/ScsMasMethodology

Brock Commons Tall house UBC

B.C. building code adjusted upwards to allow 12-storey wood buildings

OKANAGAN FALLS, B.C. — The height limit for wood buildings in British Columbia is rising to 12 from six storeys in a move that Premier John Horgan expects to spur development using timber and give the province a head start on other parts of the country.

B.C. is changing its building code to allow the construction of taller wood buildings as a safe, economic and environmental alternative to concrete apartments and office buildings, Horgan said Wednesday.

B.C.’s building code changes come one year ahead of expected changes in the national building code, which are also expected to increase height limits for wood buildings to 12 storeys, Horgan said.

“We’re not waiting for the rest of the country to get here,” said Horgan. “We already know that the product we’re building, that we’re creating here, is fire resistant. We know that we can build faster and we know it’s better for the environment.”

He said he expects local governments and First Nations to approve more wood buildings for family apartments, student residences and business locations.

Horgan made the announcement at Structurlam, a timber production company in Okanagan Falls near Penticton that has been a North American leader in wood products used in buildings.

“We need to get more value out of every log,” he said. “It’s cost effective. It’s environmentally sensitive and it’s putting British Columbians to work with a B.C. product.”

A mass timber building is one where the primary load-bearing structure is made of either solid or engineered wood. Encapsulated mass timber is where the timber components are surrounded by fire-resistant materials like drywall.

Hardy Wentzel, chief executive officer of Structurlam, said the height change allows the company to continue being an innovator on mass timber products and building designs.

He said the company uses B.C. wood, including spruce, pine and fir.

Canada is a leader in wood technology, using different forms of timber and lumber to create products that can be formed into pre-fabricated wood used as beams, columns, walls, arches, floors and roofs, says the Canadian Wood Council.

Wentzel said mass timber buildings are safe and faster to build, but the long-standing tradition of concrete buildings holds strong.

“The builders may be set in their ways, but when they actually do the economics of building 12-storey wood buildings versus a 12-storey concrete building, and they do a full cradle to grave analysis, they’re going to find this is the better way to build,” he said.

Eric Andreasen, vice-president of sales and marketing at Vancouver building company Adera, welcomed the change, which he said will likely convince more developers to consider wood buildings.

“I do believe a lot of people are going to start having an awareness and that’s going to lead to more tall wood construction,” he said. “It’s got some natural characteristics and it just looks better.”

A Housing Ministry news release says mass timber buildings meet or exceed performance standards for safety, structural resilience and fire protection. It says the 17-storey Brock Commons student residence at the University of British Columbia was the world’s tallest mass-timber building when it opened in 2017.

— By Dirk Meissner in Victoria

United States

U.S. Payrolls, Wages Cool as Trade War Weighs on Economy

By Reade Pickert and Jeff Kearns

June 7, 2019 6:30 AM Updated on June 7, 2019 8:22 AM

U.S. Payrolls, Wages Cool as Trade War Weighs on Economy

By Reade Pickert and Jeff Kearns

June 7, 2019 6:30 AM

- Revisions subtract 75,000 jobs from prior two months

- Unemployment rate unchanged at half-century low of 3.6%

What the U.S. May Jobs Report Means for the Fed and Markets

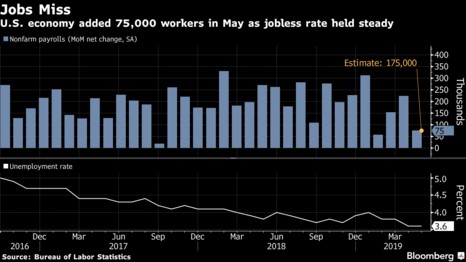

U.S. employers added the fewest workers in three months and wage gains cooled, suggesting broader economic weakness and boosting expectations for a Federal Reserve interest-rate cut as President Donald Trump’s trade policies weigh on growth.

Non farm payrolls rose 75,000 in May after a downward revised 224,000 advance the prior month, according to a Labor Department report Friday. The increase missed all estimates in Bloomberg’s survey calling for 175,000. The jobless rate held at a 49-year low of 3.6% while average hourly earnings climbed 3.1% from a year earlier, less than projected.

The dollar and Treasury yields fell as the data signaled the labor market — a pillar of strength for an economy headed for a record expansion — was facing new pressures even before Trump threatened tariffs on Mexican goods in addition to proposed higher levies on Chinese imports. Retail sales, factory output and home purchases have shown the economy struggling this quarter after better-than-expected growth in the first three months of the year.

Read more: Bets on July Fed Rate Cut Gain Momentum After U.S. Jobs Report

“It definitely looks like we’ve downshifted in the pace of job growth,” said Michael Feroli, chief U.S. economist for JPMorgan Chase & Co. “Overall it’s a disheartening report particularly since you may have some trade effects there, but a lot of the trade tensions escalated” since the reference period for the Labor Department’s surveys in the middle of the month, he said.

The U.S. added 75,000 jobs in May and the jobless rate held at 3.6%. Mike McKee reports.

Daybreak: Americas.” (Source: Bloomberg)

Stocks jumped as traders focused on the interest-rate implications of the report. Fed funds futures showed a quarter-point cut almost fully priced in for July.

Fed policy makers have described the economy as solid, though recent remarks from Chairman Jerome Powell signaled openness to lower rates if needed. St. Louis Fed President James Bullard, who votes on policy this year, this week became the first official to indicate likely support for a rate cut; others suggested they’re waiting for more data.

As the world’s largest economy nears its longest-ever expansion in July, the employment report may amplify rhetoric that Fed rate cuts are needed to support growth.

Revisions subtracted 75,000 jobs from the prior two months, bringing the three-month average to 151,000.

What Our Economists Say

“The disappointing payroll result suggests uncertainty surrounding trade tensions are starting to extract a larger toll on the domestic economy. The payroll diffusion index, a measure of the breadth of hiring in the labor market, also worsened, sending an additional warning that tariffs are hindering job creation.”

— Eliza Winger, associate

Payroll changes by industry showed broad weakness. Manufacturing growth slowed to 3,000 jobs, as forecast, while construction employment expanded by 4,000, down from the prior month. Professional and business services added 33,000, about half the prior month’s number.

Retail jobs fell by 7,600 for a fourth-straight drop while transportation and warehousing and non-durable goods also slipped. Government payrolls contracted by 15,000, highlighted by drops in state and local education.

Kevin Haslett, the departing chairman of Trump’s Council of Economic Advisers, said on CNBC that the report was disappointing, but wage gains mean the economic outlook is still solid. Flooding in the central U.S. may have reduced the May payroll number by 40,000 jobs, Haslett said on Bloomberg Television.

The Labor Department report, which sometimes can mention special factors that affected jobs or survey responses, didn’t cite any such as weather for the latest month. The number of people not at work due to bad weather was 72,000 in May, a figure roughly in line with the same month in prior years. It tends to spike during major storms or natural disasters.

Cooling Pay

Wage growth in U.S. climbed 3.1% in May from a year earlier, slightly less than forecast

Average hourly earnings rose 0.2% from the prior month, missing estimates. That indicates the tight labor market may offer limited support for consumer spending.

The participation rate or share of working-age people in the labor force, held at 62.8%. The average workweek for all private employees was unchanged at 34.4 hours.

Other Details

- The U-6, or underemployment rate, fell to 7.1% from 7.3%; the gauge includes part-time workers who’d prefer a full-time position and people who want a job but aren’t actively looking.

- Private employment grew by 90,000 after a downward revised 205,000 increase. This follows ADP Research Institute data earlier this week that showed companies added the fewest workers since 2010 in May.

- Economists in Bloomberg’s survey had projected 3.6% unemployment and annual wage gains at 3.2%.

— With assistance by Chris Middleton, and Sophie Caronello

(Updates with Hassett comment in 11th paragraph.)

Fed Scraps Patient Approach and Opens Door to Potential Rate Cut

By Craig Torres and Christopher Condon

June 19, 2019 12:00 PM Updated on June 19, 2019 4:03 PM

- Holds rates steady for now as 8 officials project cuts in 2019

- Fed Chair Powell says he fully intends to serve four-year term

The Federal Reserve signaled it was ready to lower interest rates for the first time since 2008, citing “uncertainties” that have increased the case for a cut as officials seek to prolong the near-record U.S. economic expansion.

While Chairman Jerome Powell and fellow central bankers left their key rate in a range of 2.25% to 2.5% on Wednesday, they dropped a reference in their statement to being “patient” on borrowing costs and forecast a larger miss of their 2% inflation target this year.

“My colleagues and I have one overarching goal, to sustain the economic expansion,” Powell told a press conference following the decision. He noted that apparent progress on trade talks had “turned to greater uncertainty” and many Fed officials “now see that the case for somewhat more accommodative policy has strengthened.”

The shift followed attacks on the Fed by President Donald Trump for not doing more to bolster the economy and Tuesday’s report by Bloomberg News that the president asked White House lawyers earlier this year to explore options for demoting Powell from the chairmanship.

U.S. stocks rose after the decision and Treasuries erased losses. Yields on benchmark 10-year Treasuries fell to 2.03%. Fed funds futures priced in increased odds of a rate cut at the July meeting and investors now see around 74 basis points of easing by the end of the year.

Powell ducked a question on whether the Fed would ease by as much as a half-percentage point, if it decided to act. But he acknowledged there was merit in the argument that a central bank should move decisively when its policy rate is already close to zero.

“An ounce of prevention is worth a pound of care,” Powell said. “That is a valid way to think about policy in this era” of near-zero rates, he said.

Read more: Fed Likely to Consider Half-Point Move If and When It Cuts

The pivot toward easier monetary policy shows the Fed swinging closer to the view of most investors that Trump’s trade war is slowing the economy’s momentum and that rates are too restrictive given sluggish inflation.

The Federal Open Market Committee (FOMC) said in a statement that in light of increased uncertainties and muted inflation pressures “the committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.”

The FOMC vote was not unanimous, with St. Louis Fed President James Bullard seeking a quarter-point rate cut. His vote marked the first dissent of Powell’s 16-month tenure as chairman.

Officials were starkly divided on the path for policy. Eight of 17 penciled in a reduction by the end of the year as another eight saw no change and one forecast a hike, according to updated quarterly forecasts.

Political Shadow

Trump’s attacks on the Fed risk casting a political shadow over whatever policy decision the Fed makes, though Powell and his colleagues say they’re focusing only on the economic goals Congress gave them.

Powell declined to comment directly on the president’s public criticism of the central bank, but said the Fed is “deeply committed to carrying out our mission” and that its independence from politics is an “important institutional feature that has served the economy and the country well.”

In the statement, officials downgraded their assessment of economic activity to a “moderate” pace from “solid” at their last gathering. They also noted that “growth of household spending appears to have picked up from earlier in the year” and that indicators of business fixed investment “have been soft.” They repeated that the labor market “remains strong.”

Recent U.S. economic data have been mixed. Consumer spending held up in May, but job gains were disappointing, and some gauges of business sentiment have cooled on uncertainty around the outlook for trade. The Fed remains be devilled by inflation continuing to undershoot the central bank’s 2% target despite unemployment being at a 49-year low.

What Our Economists Say

“Bloomberg Economics retains the view that if economic data firm somewhat and trade tensions cool, the Fed may avoid embarking on insurance cuts — or at the very least will deliver far less accommodation than what markets have started to price in.”

–Carl Riccadonna, Yelena Shulyatyeva and Eliza Winger

Click here for more.

The Fed, which raised interest rates four times last year and as recently as December projected further hikes in 2019, isn’t alone in changing tack. European Central Bank President Mario Draghi on Tuesday paved the way for a rate cut, and central banks in Australia, India and Russia have lowered borrowing costs this month.— With assistance by Chris Middleton, Alexandre Tanzi, Ben Holland, Katia Dmitrieva, and Reade Pickert

Photographer: Luke Sharrett/Bloomberg

economics

U.S. Home builder Sentiment Unexpectedly Posts First Drop in 2019

By

June 17, 2019 8:00 AM

Sentiment among U.S. homebuilders unexpectedly posted the first decline this year, suggesting lower mortgage rates are failing to give the housing market a sustained boost amid property prices that remain out of reach for many buyers.

The National Association of Home Builders/Wells Fargo Housing Market Index fell two points to 64 in June, according to a report Monday that was below all estimates in a Bloomberg survey predicting a gain. All three components declined, with sales expectations hitting a four-month low. Readings above 50 indicate more builders view conditions as good than poor.

Key Insights

- Homebuilders cited rising costs for development and construction, along with concern over trade issues and labor shortages, according to the report. The figures contrast with some signs that the housing market is picking up, as a gauge of mortgage applications jumped earlier this month by the most in four years, while new-home construction advanced in March and April.

- The report follows a record decline Monday in the New York Fed’s Empire State factory index, suggesting some parts of the economy are heading to a weak finish in the second quarter. Reports out Friday showed solid retail sales and manufacturing output in May, indicating growth is uneven as Federal Reserve policy makers prepare to discuss interest rates at a meeting this week. Investors expect the central bank to lower borrowing costs in July.

Official’s View

“Despite lower mortgage rates, home prices remain somewhat high relative to incomes, which is particularly challenging for entry-level buyers,” NAHB Chief Economist Robert Dietz said in a statement. “Builders continue to grapple with excessive regulations, a shortage of lots and lack of skilled labor that are hurting affordability and depressing supply.”

Get More

- The index declined in the Northeast and West while rising in the Midwest to the highest since October. It was unchanged in the South.

- Economists in a Bloomberg survey had projected the main housing sentiment index would rise from 66 to 67.

- The Washington-based trade association represents more than 140,000 members in areas ranging from building and remodeling to housing finance.

— With assistance by Jordan Yadao

Housing Starts Take a Step Back in May

Posted by John Greene on June 20, 2019

Despite some promising signs in April—and on the heels of March data that was revised upward—the US homebuilding industry can’t seem to string together a few consecutive months’ worth of significant growth. Housing starts inched down in May, surprising economists and analysts who had predicted another month of gains now that we’ve entered peak building season.

Housing Starts, Permits & Completions

Privately-owned housing starts decreased 0.9 percent in May to a seasonally adjusted annual rate (SAAR) of 1.269 million units. Single-family starts decreased 6.4 percent to a rate of 820,00 units; starts for the volatile multi-family housing segment surged 10.9 percent to a rate of 449,000.

Privately-owned housing authorizations inched up 0.3 percent to a rate of 1.294 million units in May. Single-family authorizations were up 3.7 percent at a pace of 815,000 units. Privately-owned housing completions were down 9.5 percent to a SAAR of 1.213 million units. Per the US Census Bureau Report, seasonally-adjusted total housing starts by region included:

- Northeast: -45.5 percent (+84.6 percent last month)

- South: +11.2 percent (-5.7 percent last month)

- Midwest: -8.0 percent (+42.0 percent last month)

- West: -2.4 percent (-5.5 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -25.8 percent (+29.6 percent last month)

- South: +3.3 percent (-5.6 percent last month)

- Midwest: -5.8 percent (+37.9 percent last month)

- West: -19.9 percent (+13.7 percent last month)

Home builder confidence dropped two points in June to 64, per the National Association of Home Builders’ (NAHB) index. The 30-year fixed mortgage rate continued to decline in May, dropping to 4.07 percent for the month, which is 11.3 percent lower than a year ago. The rate has now dropped 16.4 percent since peaking at 4.87 in November 2018.

“Single-family permits usually track new home sales but are lagging behind, either because homebuilders doubt the recent revival in sales will last – we think it will – and/or because they have too much inventory still after the disastrous drop in sales in Q4 last year,” said Ian Shepherdson, chief economist for Pantheon Macro. “If we’re right, and new home sales rise in the second half of the year, new construction will follow.”

For comprehensive real estate trend analysis please refer to PWC outlook reports for Canada and USA. https://www.pwc.com/ca/en/industries/real-estate/emerging-trends-in-real-estate-2019.html